Comprehensive Credit Reporting - Lenders new requirements

Comprehensive credit reporting, a crucial step when assessing a loan application is assessing past repayment history. A credit search is one way lenders do this. A credit search will show if an applicant has been bankrupt, defaulted on both financial and non-financial accounts (i.e. mobile phone, power, personal loans or home loans) and prior enquiries for credit. This is called negative credit reporting – only adverse information listed. However, from 1st July 2018 the major banks have been required to list positive history.

This is called Comprehensive Credit Reporting and was introduced back in 2014. Yet wasn’t embraced by lenders. The Government then mandated that the big four must share their majority of data by 1st July 2018. The information shared will now show all accounts (previous and current) held with these institutions. This includes, credit cards, personal loans and home loans. Specifically it will show the last 2 years of payment history, account balance and limit.

Currently, each person has a credit score which is calculated by a closely guarded algorithm by a credit agency (Equifax (previously known as Veda), Dun and Bradstreet, etc.). As they only had a small of amount of data to work from (i.e. the negative info) the scores were based on assumptions and weren’t that accurate. For example, a credit report shows enquiries for 3 credit cards and a mortgage. There is no adverse info (i.e. defaults). Hence the system assumes that a credit card and mortgage account exist and the absence of any negative info, it is assumed these accounts are up to date. Thus a good score is calculated. Whereas with the new set of positive data starts to provide a much clearer and up to date financial picture.

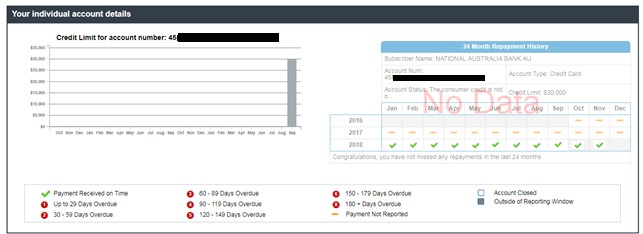

Below is a screenshot of what it looks like. As you can see it shows the account limit, the payment history for last 2 years and type of facility.

Your credit score will change as the new info is fed into the credit report agency database; both negatively and positively. For existing loans, this may assist in gaining better terms as you now may have more leverage to show that switching to a new lender should be that much easier. Likewise for new loans - although keep in mind that lenders will look past your score and read the report in its entirety. So, if you have a good credit score (as your recent repayment history is up to date) yet have had payment problems in the past then be prepared to be asked some questions. As more and more lenders start to share their data, this should speed up and lessen the document burden usually experienced when applying for a new loan as all the financial info is now housed within one report.

The credit reporting agencies can provide you with a copy of your report. There is a free service which usually takes 2 weeks to receive. Alternativity you can subscribe to their paid service where you will receive the report instantly. They also provide services which notify you of any adverse info listed and any enquiries made.

As so much data is now being shared and readily accessible, it is important to ensure that all financial commitments are made on time. As a missed payment may “mark” your file and impact your credit score long after the event.

Comprehensive credit reporting, a crucial step when assessing a loan application is assessing past repayment history. A credit search is one way lenders do this. A credit search will show if an applicant has been bankrupt, defaulted on both financial and non-financial accounts (i.e. mobile phone, power, personal loans or home loans) and prior enquiries for credit. This is called negative credit reporting – only adverse information listed. However, from 1st July 2018 the major banks have been required to list positive history.

This is called Comprehensive Credit Reporting and was introduced back in 2014. Yet wasn’t embraced by lenders. The Government then mandated that the big four must share their majority of data by 1st July 2018. The information shared will now show all accounts (previous and current) held with these institutions. This includes, credit cards, personal loans and home loans. Specifically it will show the last 2 years of payment history, account balance and limit.

Currently, each person has a credit score which is calculated by a closely guarded algorithm by a credit agency (Equifax (previously known as Veda), Dun and Bradstreet, etc.). As they only had a small of amount of data to work from (i.e. the negative info) the scores were based on assumptions and weren’t that accurate. For example, a credit report shows enquiries for 3 credit cards and a mortgage. There is no adverse info (i.e. defaults). Hence the system assumes that a credit card and mortgage account exist and the absence of any negative info, it is assumed these accounts are up to date. Thus a good score is calculated. Whereas with the new set of positive data starts to provide a much clearer and up to date financial picture.

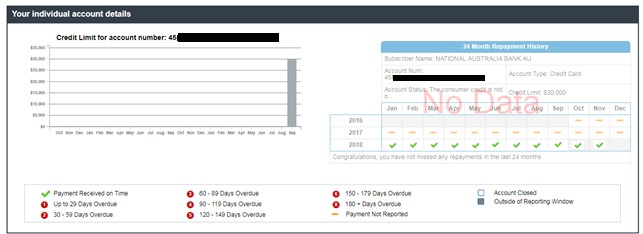

Below is a screenshot of what it looks like. As you can see it shows the account limit, the payment history for last 2 years and type of facility.

Your credit score will change as the new info is fed into the credit report agency database; both negatively and positively. For existing loans, this may assist in gaining better terms as you now may have more leverage to show that switching to a new lender should be that much easier. Likewise for new loans - although keep in mind that lenders will look past your score and read the report in its entirety. So, if you have a good credit score (as your recent repayment history is up to date) yet have had payment problems in the past then be prepared to be asked some questions. As more and more lenders start to share their data, this should speed up and lessen the document burden usually experienced when applying for a new loan as all the financial info is now housed within one report.

The credit reporting agencies can provide you with a copy of your report. There is a free service which usually takes 2 weeks to receive. Alternativity you can subscribe to their paid service where you will receive the report instantly. They also provide services which notify you of any adverse info listed and any enquiries made.

As so much data is now being shared and readily accessible, it is important to ensure that all financial commitments are made on time. As a missed payment may “mark” your file and impact your credit score long after the event.