In the world of investing, the allure of timing the market perfectly is often overshadowed by the fear of making a move at the wrong time — especially when the stock market is at an all-time high. Many investors hesitate, worried that entering the market at its peak could lead to significant losses if and when a correction occurs. This concern is not without merit; after all, buying high and selling low is the antithesis of successful investing. However, a closer look at historical data suggests that this fear might be more psychological than factual and that there could be strategic benefits to investing at market peaks. Let’s delve into why the conventional wisdom of caution at all-time highs might not hold up under scrutiny.

Understanding Market Highs

What Defines an All-Time High

An “all-time high” in the stock market is a point at which a stock index reaches its highest value in history. This milestone is significant not only for its financial implications but also for the psychological impact it has on investors. It represents a moment of peak valuation, prompting a mix of optimism for continued growth and anxiety over the potential for a downturn.

Frequency of All-Time Highs

The occurrence of all-time highs is more common than many investors might think. Markets have historically reached new highs with surprising regularity. This frequency suggests that all-time highs are a natural part of market cycles, rather than rare events that should prompt immediate caution. Understanding this can help demystify the occurrence and alleviate some of the fears associated with investing during these times.

Historical Analysis and Returns

When examining the stock market’s past performance, especially during periods following all-time highs, a compelling pattern emerges. Despite the intuitive fear that investing at a peak is akin to setting oneself up for a fall, historical data presents a different narrative.

Overview of Historical Returns

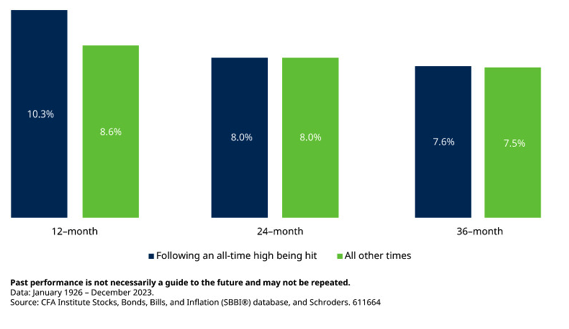

Looking back over the decades, the returns following all-time highs have been surprisingly robust. On average, the 12-month returns post an all-time high have outpaced those of other periods. This trend holds true for longer horizons as well, with two-year and three-year returns showing slightly superior averages when the investment commenced at a market peak. These statistics challenge the common presumption that all-time highs are precursors to underwhelming performance.

Comparative Wealth Growth

Consider two hypothetical investment scenarios: one where $100 is invested in the stock market at an all-time high and another where the same amount is shifted to cash under the same conditions, only to be reinvested later. The stark difference in outcomes over a long period is a testament to the power of staying invested. The portfolio that remains in the market tends to grow significantly more, showcasing the cost of fear-driven decisions to exit at peaks.

This analysis illustrates not just the resilience of markets over time but also the opportunity cost associated with attempting to time the market based on peaks. It underscores the importance of a long-term perspective, particularly when faced with the psychological hurdles of investing at what might seem like the top.

The Cost of Fear

Investing at market peaks is often deterred not by empirical evidence but by psychological barriers. Understanding these barriers is crucial to overcoming them and making informed investment decisions.

Psychological Barriers to Investing

The fear of loss is a powerful deterrent. It’s hardwired into our psychology, often causing investors to react conservatively in the face of perceived risk. The thought of investing at an all-time high triggers this fear, leading many to wait for a “better time” to invest, which, in their minds, is often after a market correction. However, this strategy overlooks the market’s potential for continued growth, even from its peaks, and the difficulty of accurately predicting market downturns.

Lost Opportunities

By succumbing to the fear of investing at market highs, investors may miss out on substantial growth opportunities. Historical data reveals that markets tend to climb higher over the long term, and periods following all-time highs are no exception. Those who shift their investments to cash or wait on the sidelines often find that the market has moved significantly higher by the time their confidence returns. This hesitation can result in a significant opportunity cost, impacting the overall growth of their investment portfolios.

Fear, while a natural instinct, can be a costly adviser in the world of investing. The key to navigating all-time highs is not avoidance but strategy.

Strategic Investing at Highs

While investing at an all-time high may seem counterintuitive, certain strategies can help investors manage risk and potentially capitalise on the market’s upward trajectory.

Long-term Perspective

Adopting a long-term perspective is crucial. The stock market has demonstrated a consistent ability to grow over time, despite short-term volatility. Investors should focus on their long-term financial goals rather than being swayed by temporary market conditions. This approach helps in weathering the periods of uncertainty that inevitably occur at market peaks.

Diversification and Risk Management

Diversification is another key strategy. By spreading investments across various asset classes, sectors, and geographies, investors can mitigate the risk of a significant loss from any single investment. Additionally, employing risk management techniques such as dollar-cost averaging—investing a fixed amount at regular intervals—can help in reducing the impact of volatility.

Investing at market highs requires a balanced approach, incorporating a long-term outlook, diversification, and disciplined risk management. By adhering to these strategies, investors can navigate the uncertainties of all-time highs with confidence.

Conclusion

The historical performance of the stock market, even during periods following all-time highs, suggests that investing at these peaks is not as detrimental as commonly feared. While the psychological barriers to investing at market highs are real, they can be overcome with a strategic approach focused on long-term growth, diversification, and risk management. Investors should look beyond short-term market fluctuations and focus on their long-term objectives, using historical market behaviour as a guide in their investment journey.

Related Posts

As you know, we recently celebrated a major milestone – our 20th year in business. While two decades may sound…

“It’s probably those people who were thinking about it, but really didn’t have any sense of urgency, that all of a sudden, went, ‘Oh, I can see what’s coming. Let’s dive in before the tidal wave comes,” - Gareth Croy

THRIVE 2026

Ready to kickstart your path to financial freedom? Join us at THRIVE and hear live on stage from our experts,…